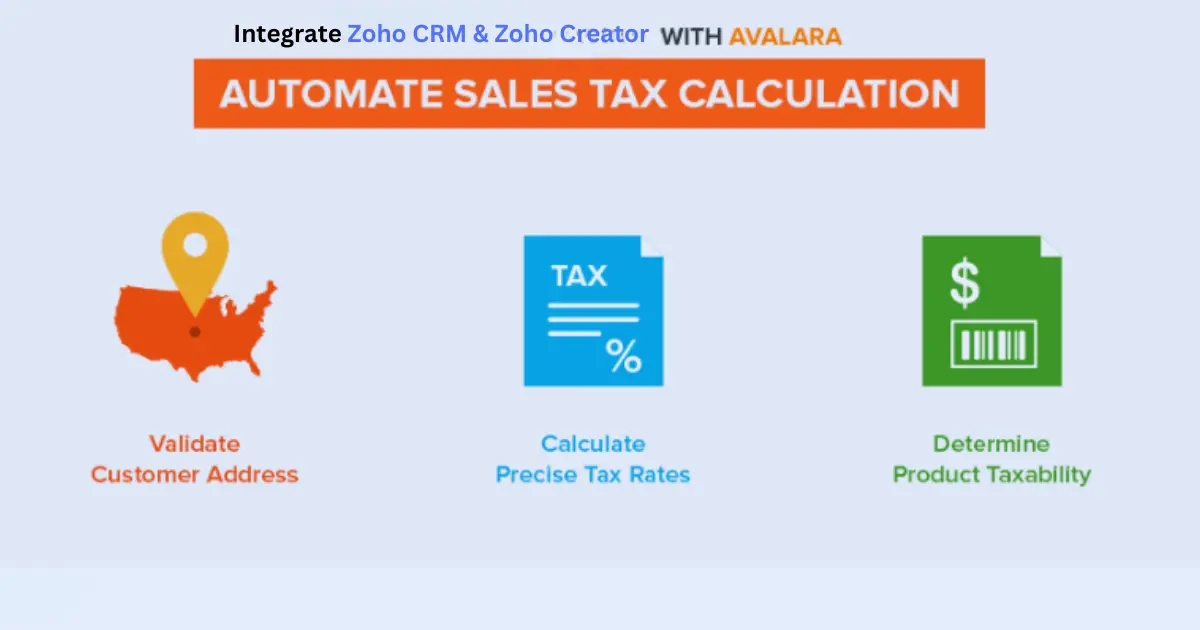

Let's say you own a business that sells products in several states at the same time. You may find it difficult to keep track of sales tax rates and exemption certificates in Zoho CRM. A sales tax software like Avalara can help make this process easier. It will automatically calculate tax rates and apply them correctly to each purchase. It will also keep track of exemption certificates and apply them correctly.

This is where Zoho CRM and Avalara AvaTax integration comes into play!

Here's how Zoho and Avalara Integration works, step-by-step:

1. Custom App for Sales Tax Calculation:

-

We have built a custom app using Zoho Creator that integrates with Avalara AvaTax.

-

This app automatically calculates the sales tax for each sale based on the customer's location and the product they're buying.

-

Avalara keeps track of the latest tax rates for all regions, ensuring your business is always tax compliant.

2. Effortless exemption certificate Validation:

Validating, managing, and storing exemption certificates can be a nightmare for companies selling products and services across multiple states. Our custom app gathers exemption certificate information from the customer during product purchase, stores it, and then sends it to Avalara for validation.

Why is Exemption Certificate validation Important ?

-

Valid exemption certificates can prevent your customers from paying unnecessary sales taxes. Exemption certificates are legal documents that prove the customer's eligibility for an exemption. Validating them ensures they are legitimate, and that the customer isn't charged for taxes they should be exempt from.

-

The customer's exemption certificate becomes invalid in the following cases:

- Missing signature/does not include a signature of the accepted signer.

- Missing issue date

- Incorrect claim type/certificate not accepted

- Document (letter, email) not recognized by state taxing authorities

- Includes name or address other than direct buyer and seller

- Showing State ID for the wrong state

-

Purchased products are not subject to sales tax if the exemption certificate is valid and current. Those who do not possess a valid exemption certificate must pay the tax, as well as any additional interest or penalties associated with it. All of these processes are handled by Avalara and the status is updated back to our custom application.

-

Simplified refund process for customers who overpaid taxes:

If the customer has already paid tax, we can initiate the refund process on our app by using Avalara Returns. Avalara will then handle returning the tax amount to the customer and updating the status back to our app. This process ensures that the customer receives their refund quickly and securely. This also ensures that tax amounts are collected accurately.

3. Real-time Updates in Zoho CRM:

The sales tax calculations, exemption certificate validation status, refund status, and tax filing information are seamlessly updated back into the relevant customer records within Zoho CRM, ensuring your customer records in Zoho CRM are always up-to-date with the latest tax details.This helps companies maintain accurate records and ensure they are compliant with all relevant taxes. It also eliminates the need to enter tax information into Zoho CRM manually, saving time and effort.

Overall, Integrating Avalara with Zoho CRM streamlines the sales tax compliance process, making it easier for businesses to manage tax calculations, exemption certificates, and simplifies refund processes, saving you time, money, and a lot of tax headaches! This integration ensures that businesses remain compliant with tax regulations while providing a seamless experience for customers.

Get answers to your most pressing questions about integrating Avalara with the Zoho Apps.