About the Client

Pure Capital operates as a Finance broker, connecting Australian borrowers with suitable lenders while managing complex application processes that involve multiple stakeholders, extensive documentation, and regulatory compliance requirements. As the business scaled, manual processes began to strain operational efficiency.

The core challenge was the loan application process: disjointed, document-heavy, and prone to error. Each application could involve multiple applicants, each requiring specific documentation, privacy consents, and tailored communications. Manual tracking across spreadsheets became time-consuming and error-prone.

Our client also needed a secure and seamless way for referrers to submit applicant leads and for customers to upload documents and receive updates on their application status.They also wanted a portal so that the referrers can also add the details of the contacts they refer.

The situation called for a major process overhaul that wouldn’t disrupt day-to-day operations but would lay the foundation for scale.

That’s when Pure Capital turned to YAALI.

The Challenge

Prior to engaging YAALI, the team at Pure Capital relied on manual tracking and fragmented systems. Document collection was inconsistent, status updates were not automated, and managing multiple applicants under a single loan deal was inefficient. These gaps led to delays, potential compliance risks, and bottlenecks in client communication.

Key issues included:

-

-

Fragmented Data Collection: Inconsistent intake of loan-related information and supporting documents across applicants.

-

Communication Bottlenecks: Manual status updates and follow-ups with clients and referrers created delays.

-

No Centralized System: Tracking multiple applicants for a single application and consolidating documents was cumbersome.

-

Lack of Automation: Sending out privacy and credit proposal documents at each application stage required manual intervention.

-

Limited Referrer Access: Referrers had no structured platform to input or track the progress of their referrals

-

The Solution:

YAALI stepped in to address these challenges by leveraging Zoho’s powerful suite of applications, customized to fit Pure Capital’s unique needs

YAALI stepped in with a clear mission: simplify and automate Pure Capital’s loan application process without compromising on compliance, usability, or user experience.

|

Module |

Purpose |

|---|---|

|

Deals |

Central hub for managing loan applications and tracking progress |

| Contacts |

Stores applicant details, including personal and contact info |

|

Accounts |

Tracks the organizations associated with applicants |

Tasks |

Automates assignments to broker support teams |

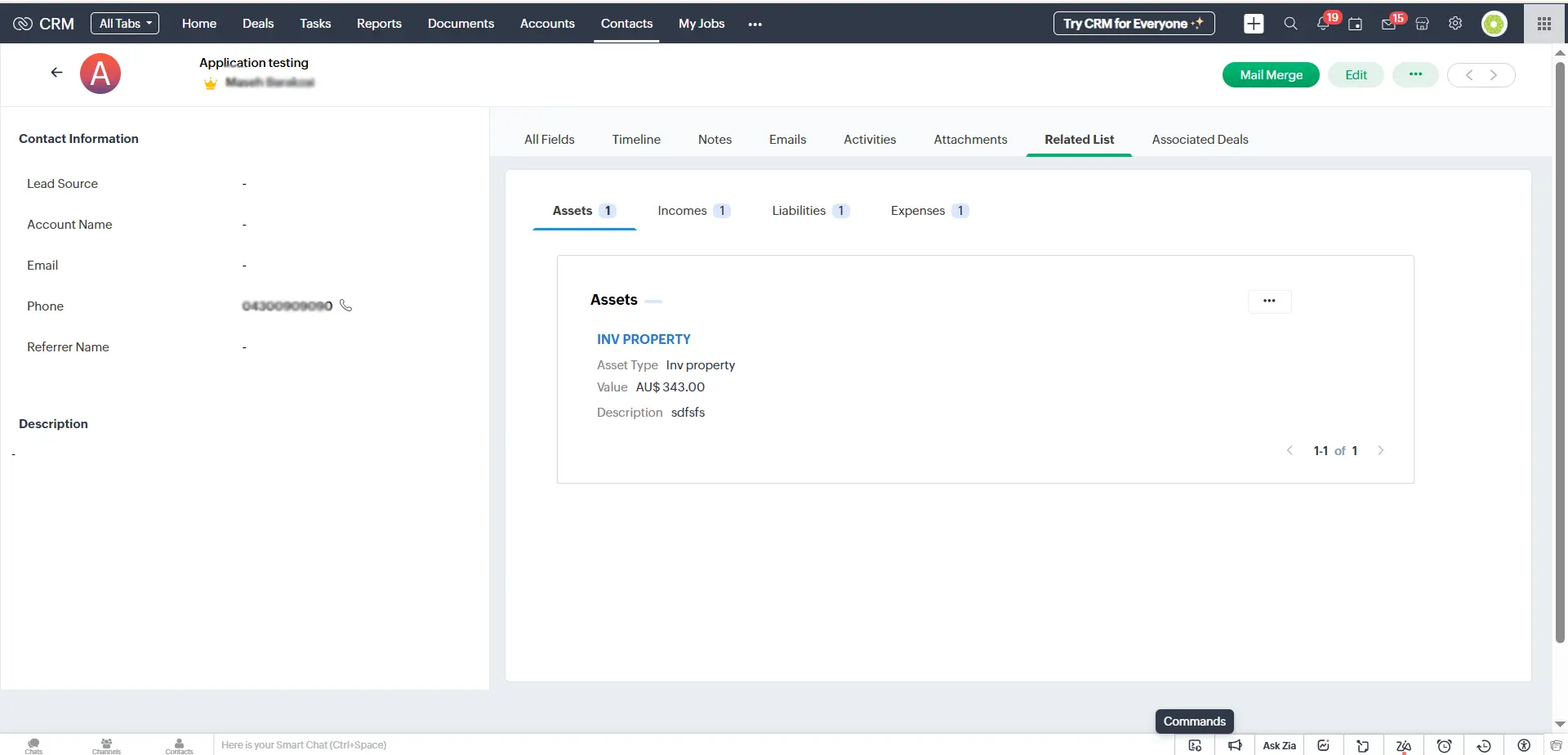

Incomes,Assets,Liabilities,Expenses |

Captures the financial profile of each applicant |

Deal x Contacts (Custom) |

Tracks required and uploaded documents for each applicant |

The implementation covered a range of Zoho apps and third-party app: Zoho CRM, Zoho Creator, Zoho Sign, and integration with CellCast (for SMS/MMS delivery) to create a cohesive, automated workflow.

Here’s how YAALI transformed Pure Capital’s operations:

1. Customized Zoho CRM Tailored To Their Business Process:

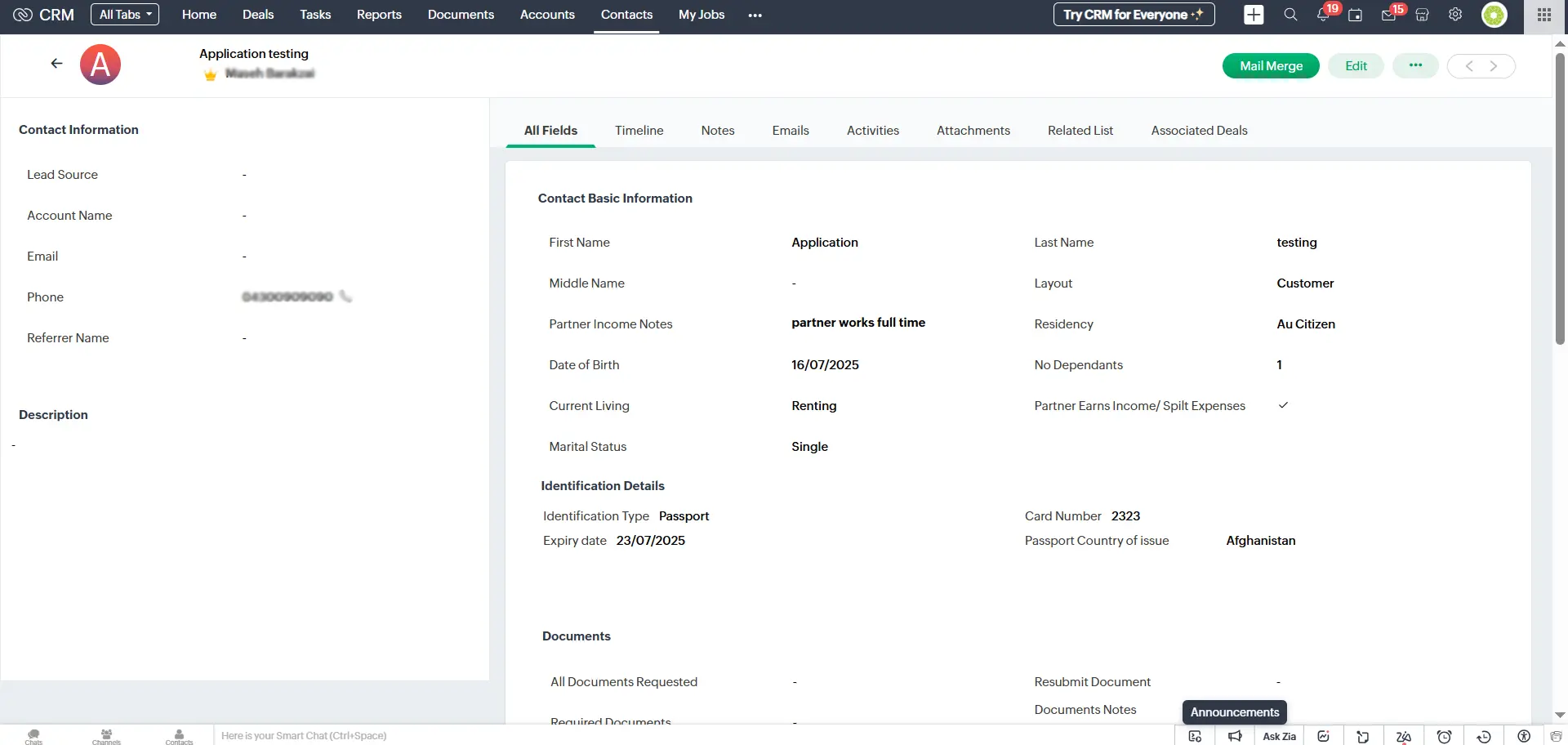

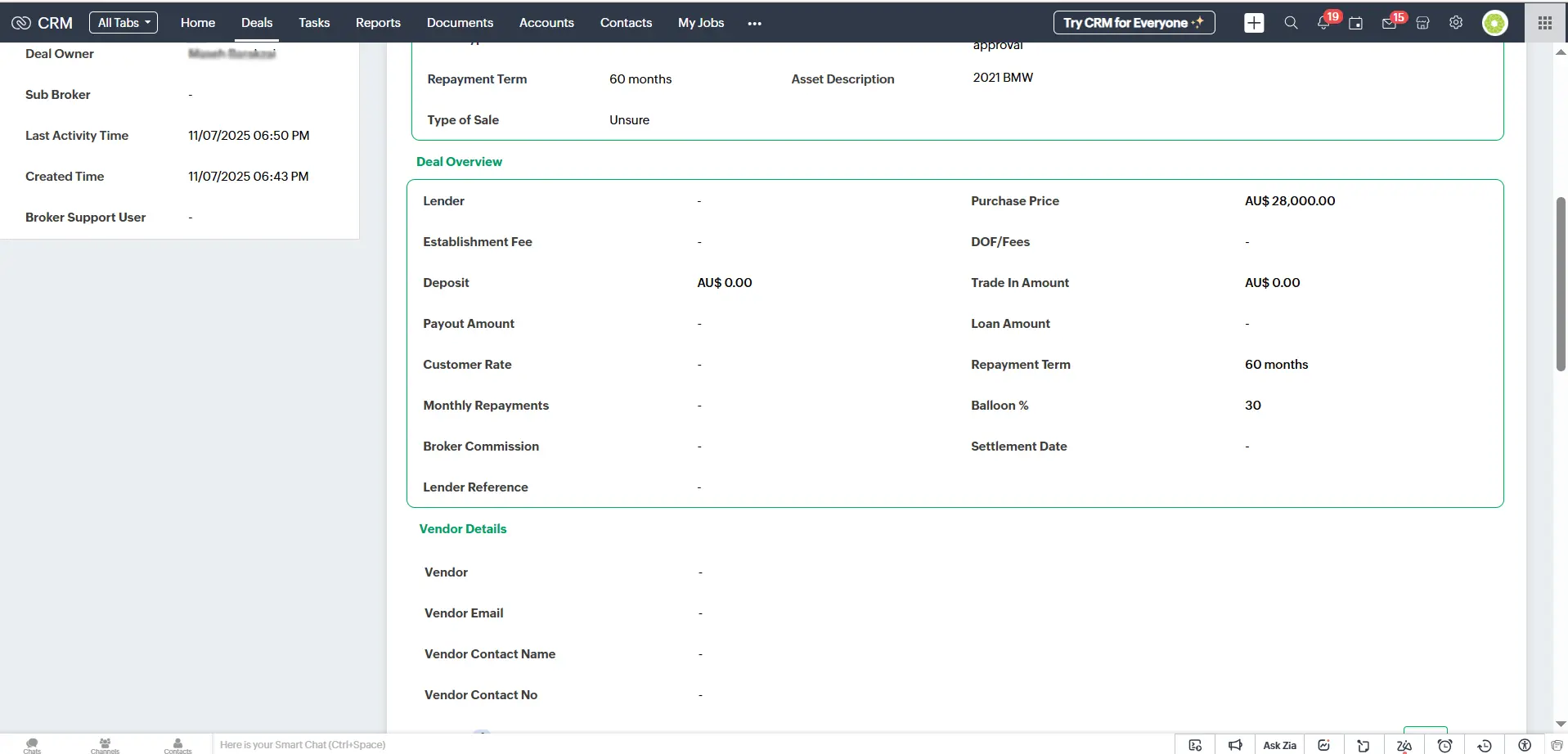

YAALI Customized Zoho CRM to mirror Pure Capital’s business flow. Custom modules were created to manage every aspect of a loan application from applicant details to financial profiles.

Key modules included:

-

-

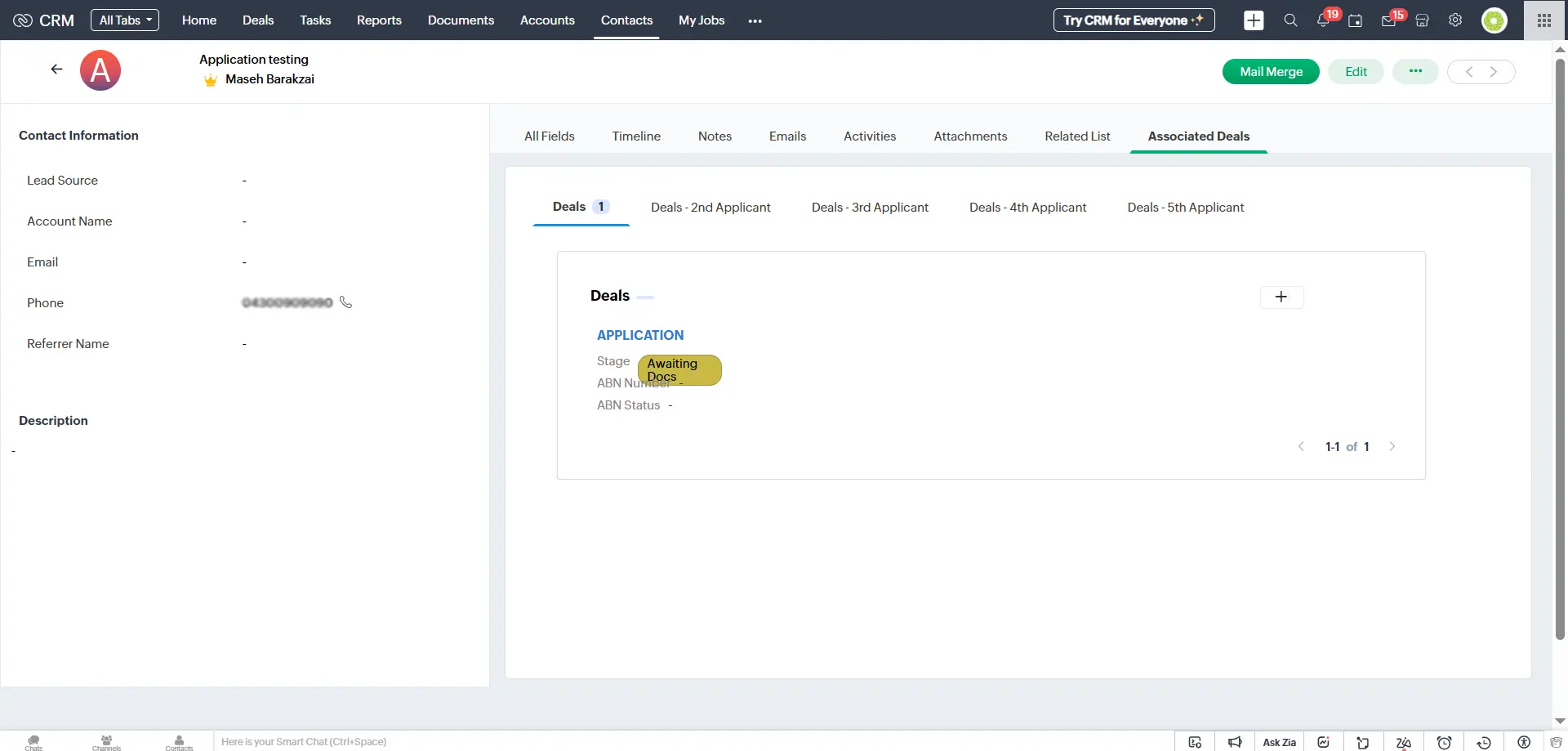

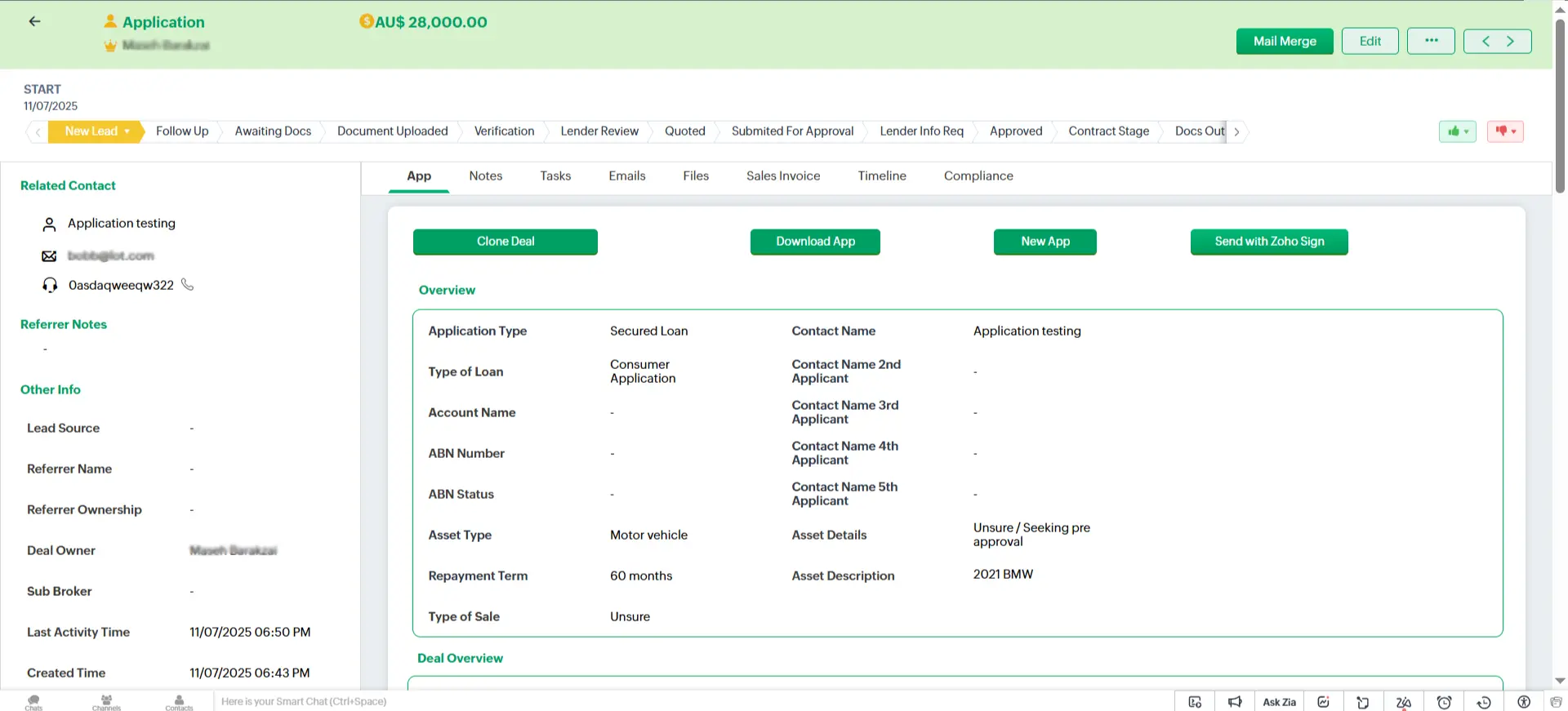

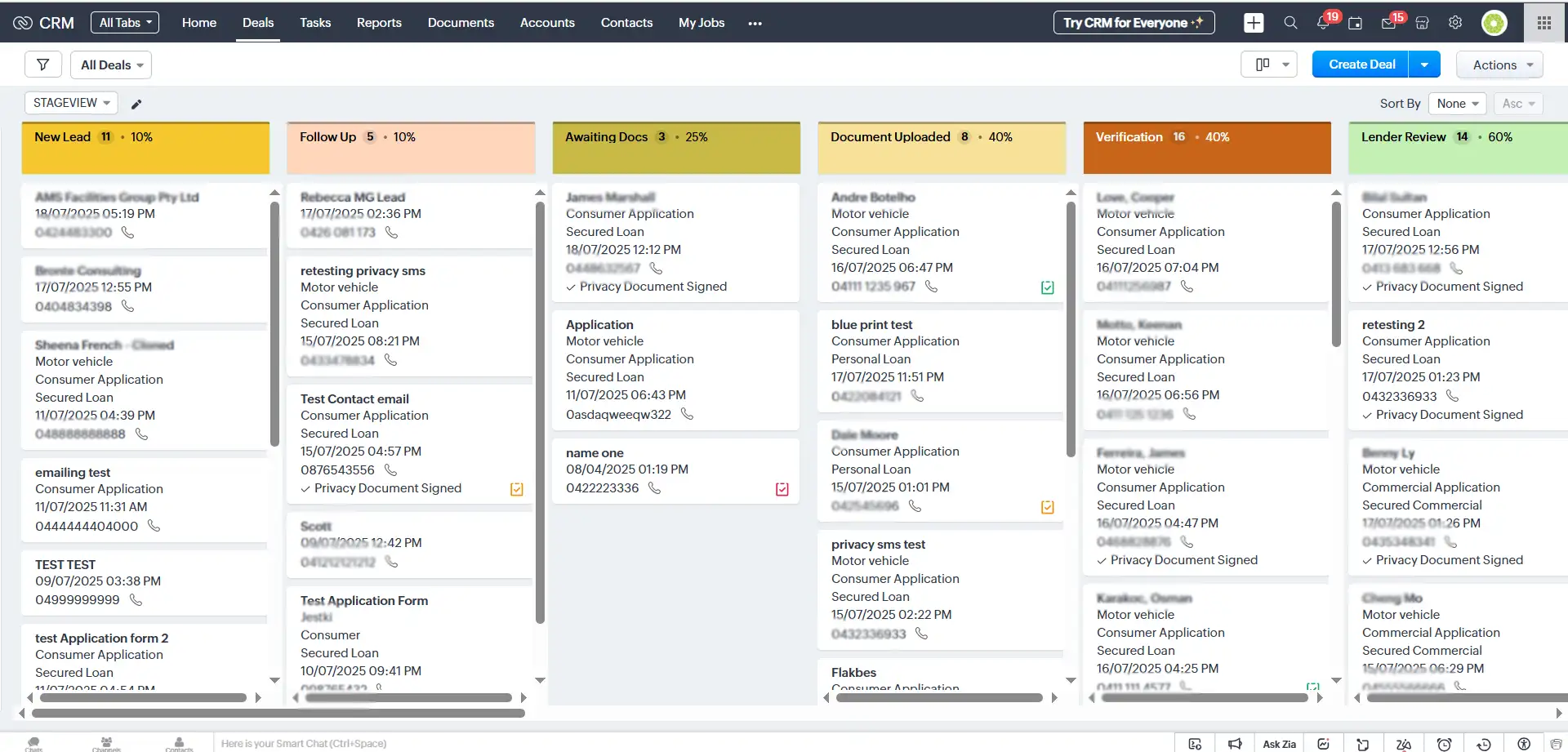

Deals: To track individual applications and progress them through predefined stages.

-

Contacts, Accounts: To organize applicant and organizational relationships.

-

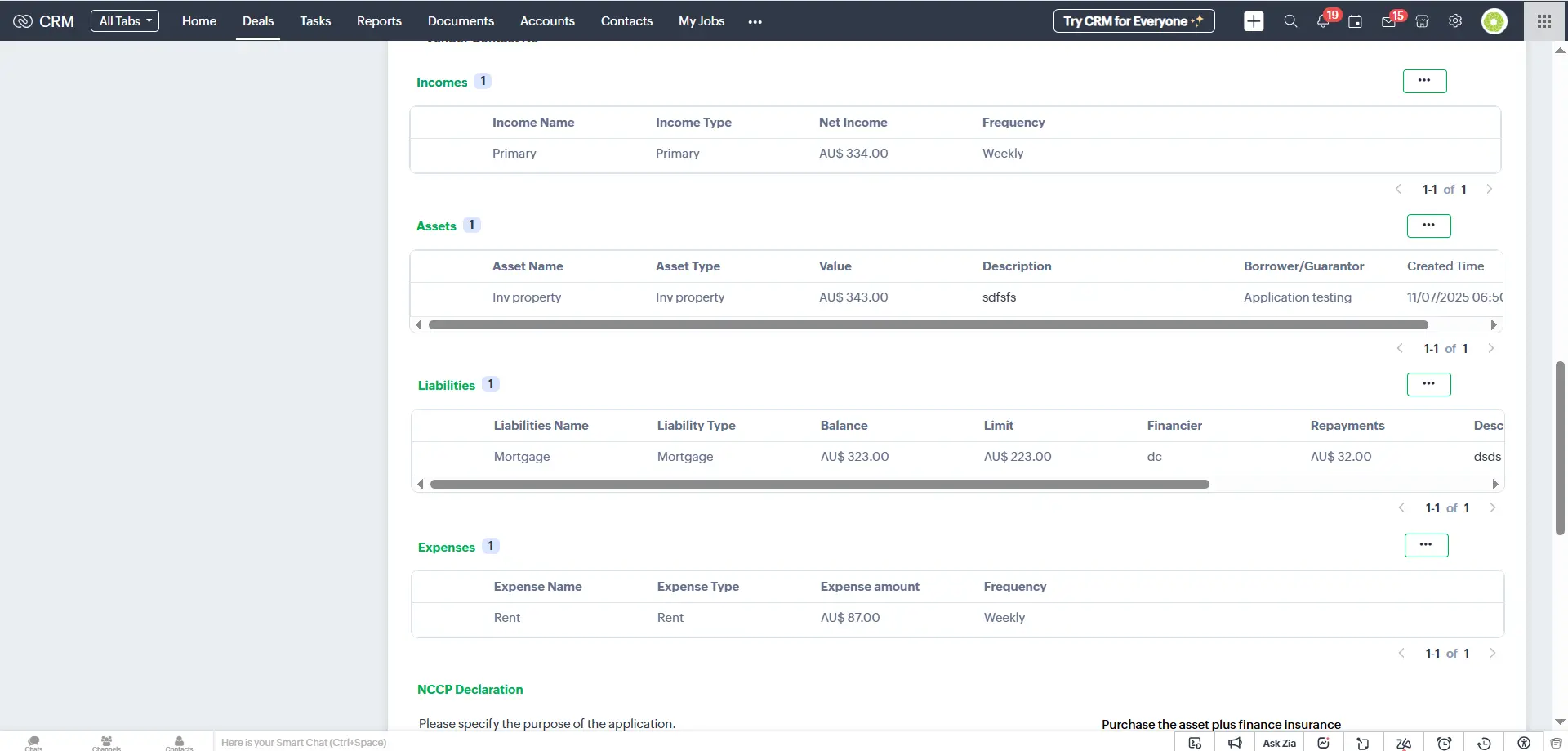

Incomes, Assets, Liabilities, Expenses: To record financial data critical to loan assessments.

-

Deal x Contacts (Custom Module): To maintain applicant-specific document tracking.

-

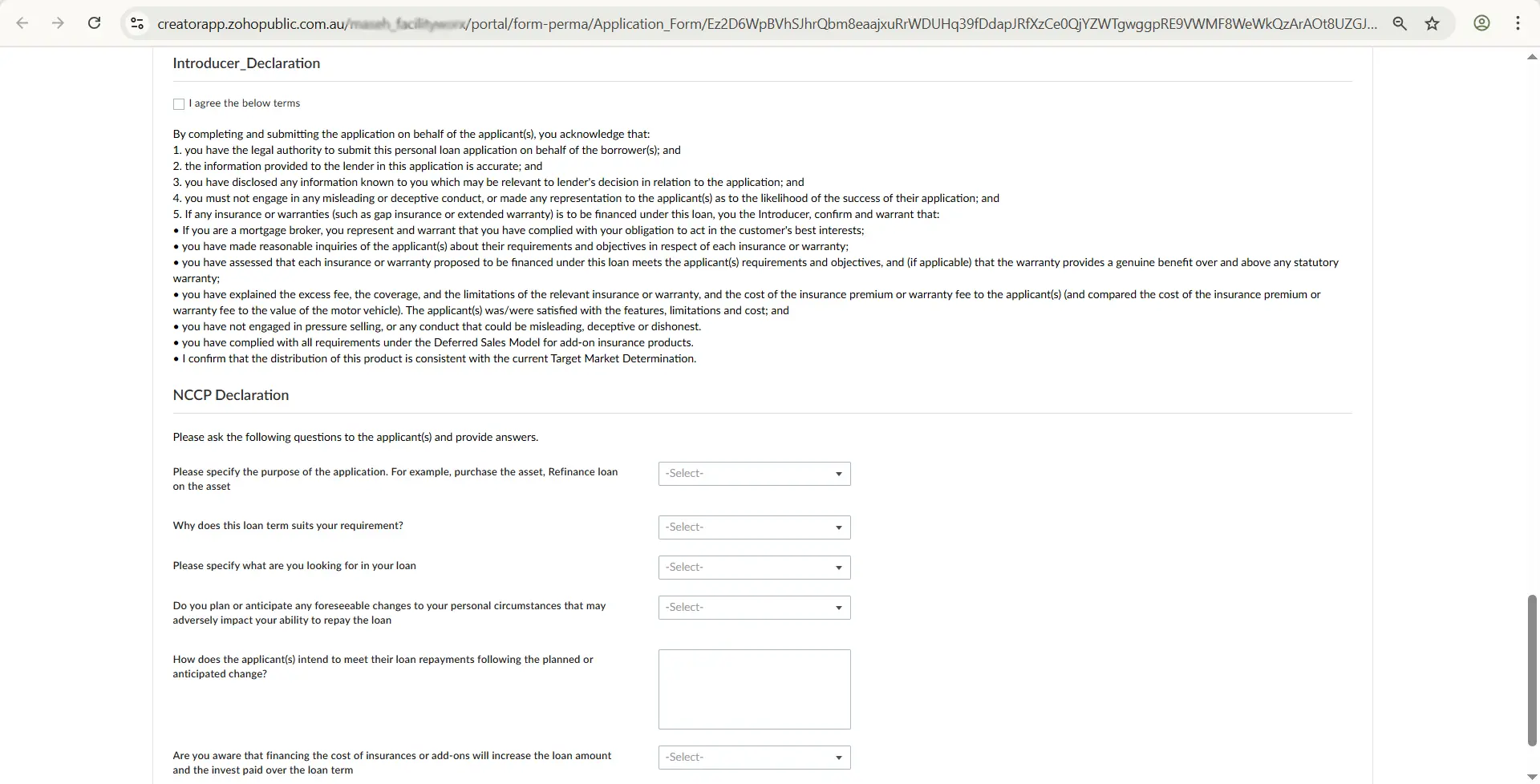

2. Streamlined Data Collection using forms in Zoho Creator app

Our Zoho Creator developers built custom forms in Zoho Creator to simplify data collection:

-

-

Application Form: Allowed applicants to submit loan details directly, reducing manual data entry.

-

Document Request Form: Enabled applicants to upload required documents securely.

-

These forms were integrated with Zoho CRM via APIs, ensuring seamless data synchronization. YAALI implemented validation rules to ensure only accurate and complete data entered the system, minimizing errors.

3. CellCast Integration for SMS Communication

YAALI integrated CellCast with Zoho CRM to enable automated communication:

-

-

Application and document request form links were sent via SMS and email, ensuring applicants could easily access and complete them.

-

Automated status updates were sent to applicants and referrers, keeping all stakeholders informed.

-

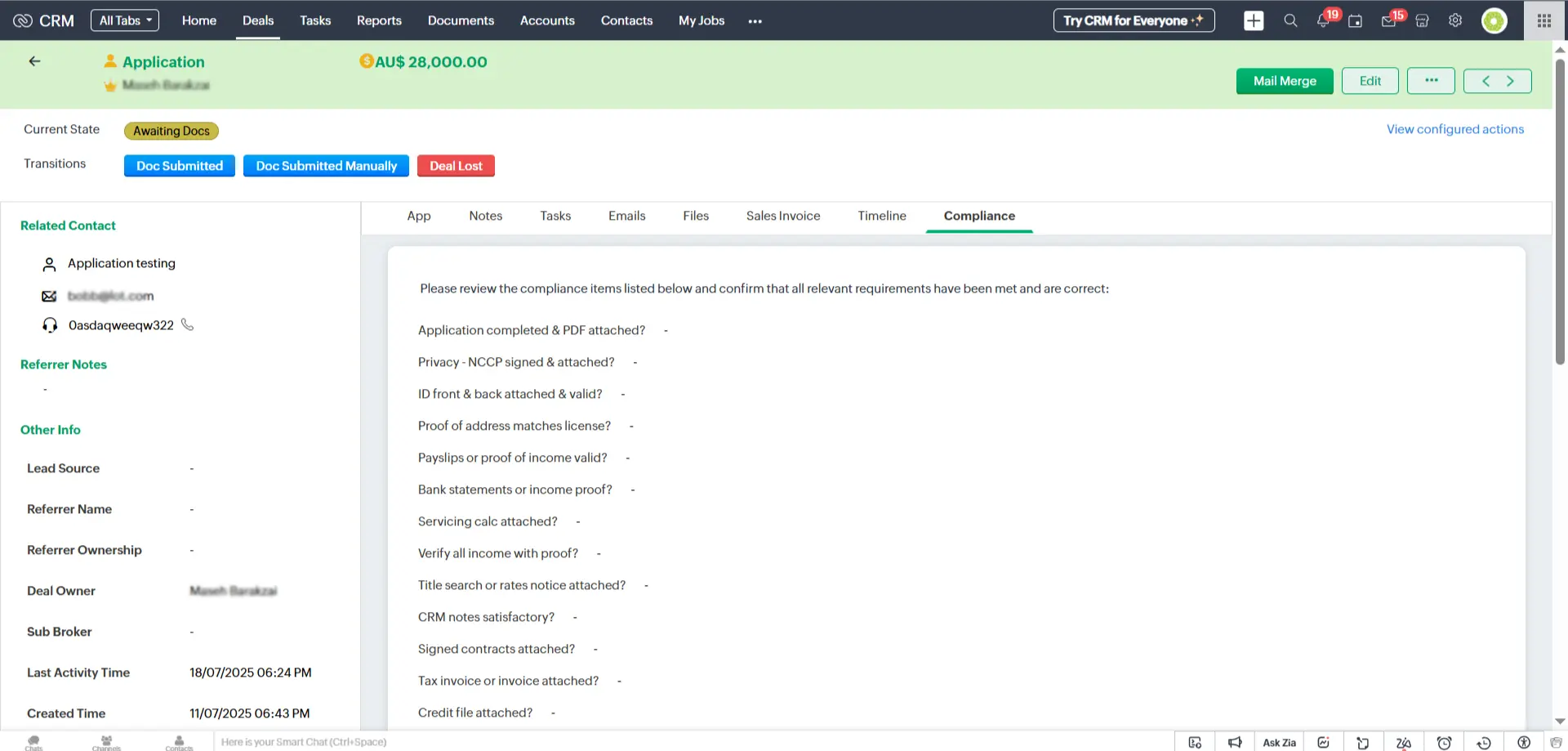

4. Automate document workflows and signature collection with Zoho Sign

Our Zoho Experts integrated Zoho Sign to automate the delivery and signing of privacy documents:

-

-

Privacy documents were automatically sent via SMS (using CellCast) based on the application type and stage.

-

Once signed by all applicants, documents were automatically stored in Zoho CRM and linked to the respective application.

-

Credit Proposal documents were emailed to the primary applicant and archived for easy retrieval.

-

This automation eliminated manual document handling, saving time and reducing errors.

5. Created Custom Portal for Referrers in Zoho CRM

To empower business partners, our Zoho CRM Developers built a Referrer Portal using Zoho CRM Portals, giving them direct access to:

-

-

Submit new leads

-

View application statuses

-

Track progress in real-time

-

This move not only improved transparency but also deepened trust and collaboration

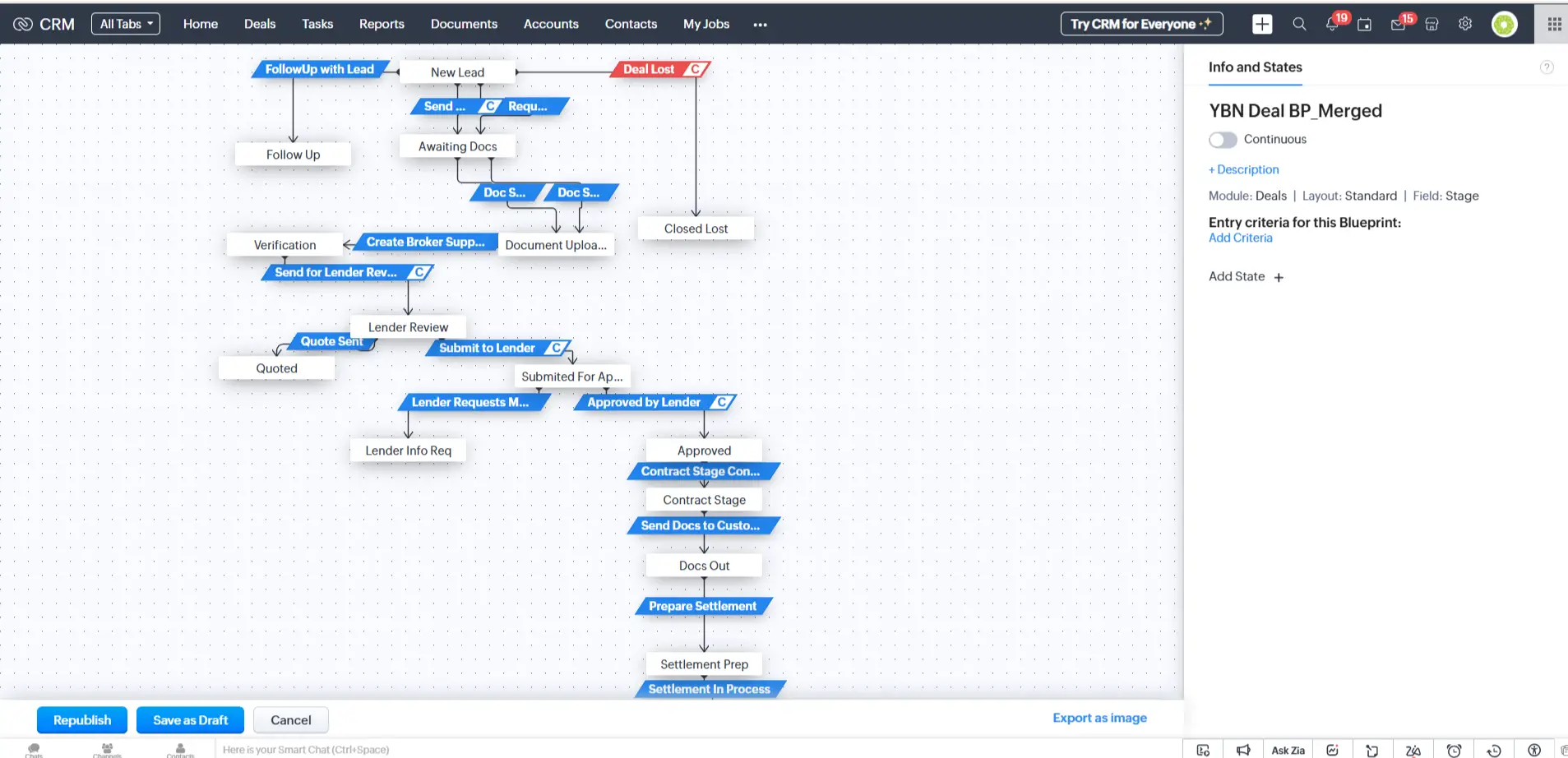

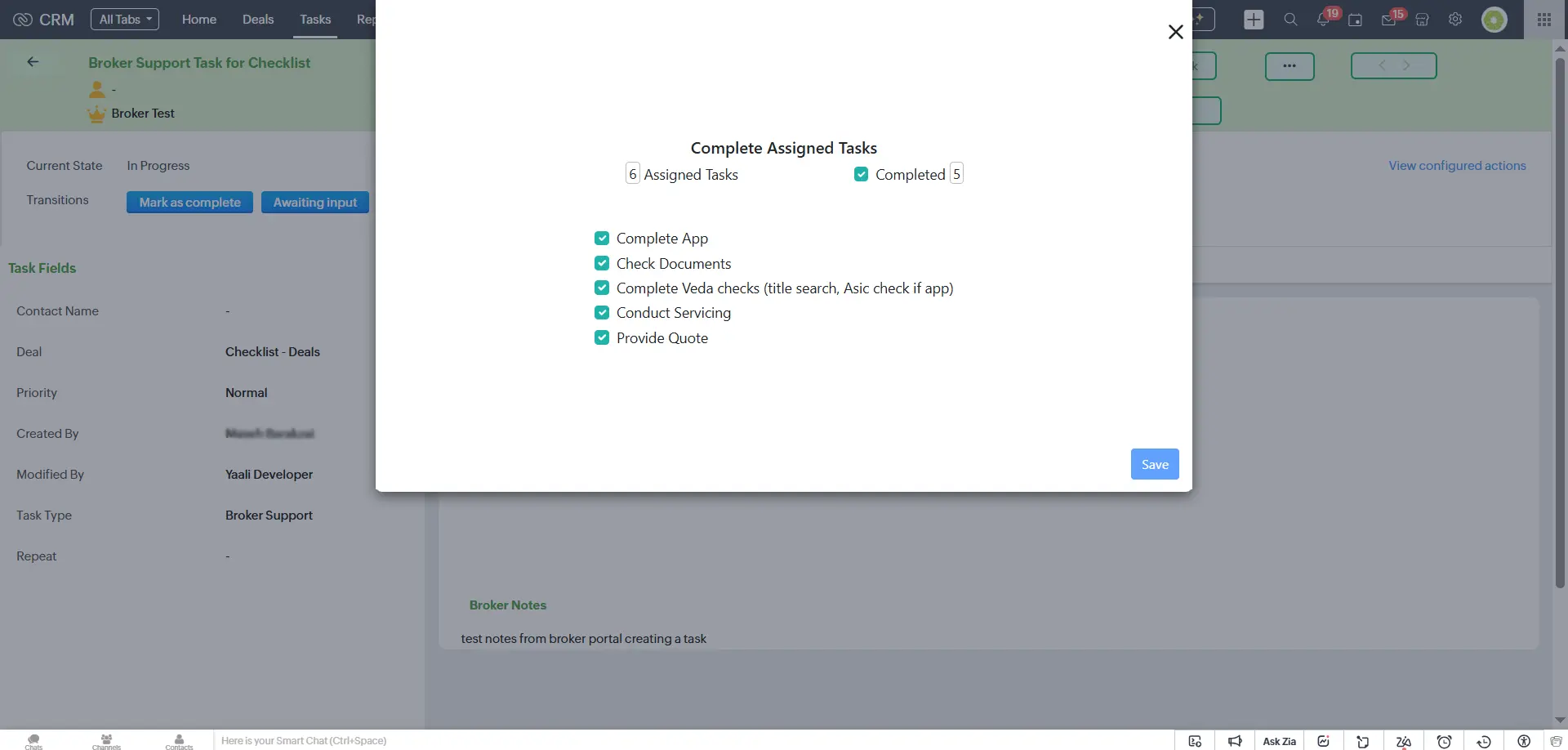

6. Loan Application Process Automation Through Blueprints & Tasks

The application process was structured using Blueprints in Zoho CRM, ensuring compliance and consistency. At each stage, automated:

-

-

Tasks were triggered for brokers

-

Emails and SMS updates were sent to applicants and referrers

-

This automation ensured that no steps were skipped and every stakeholder remained informed.

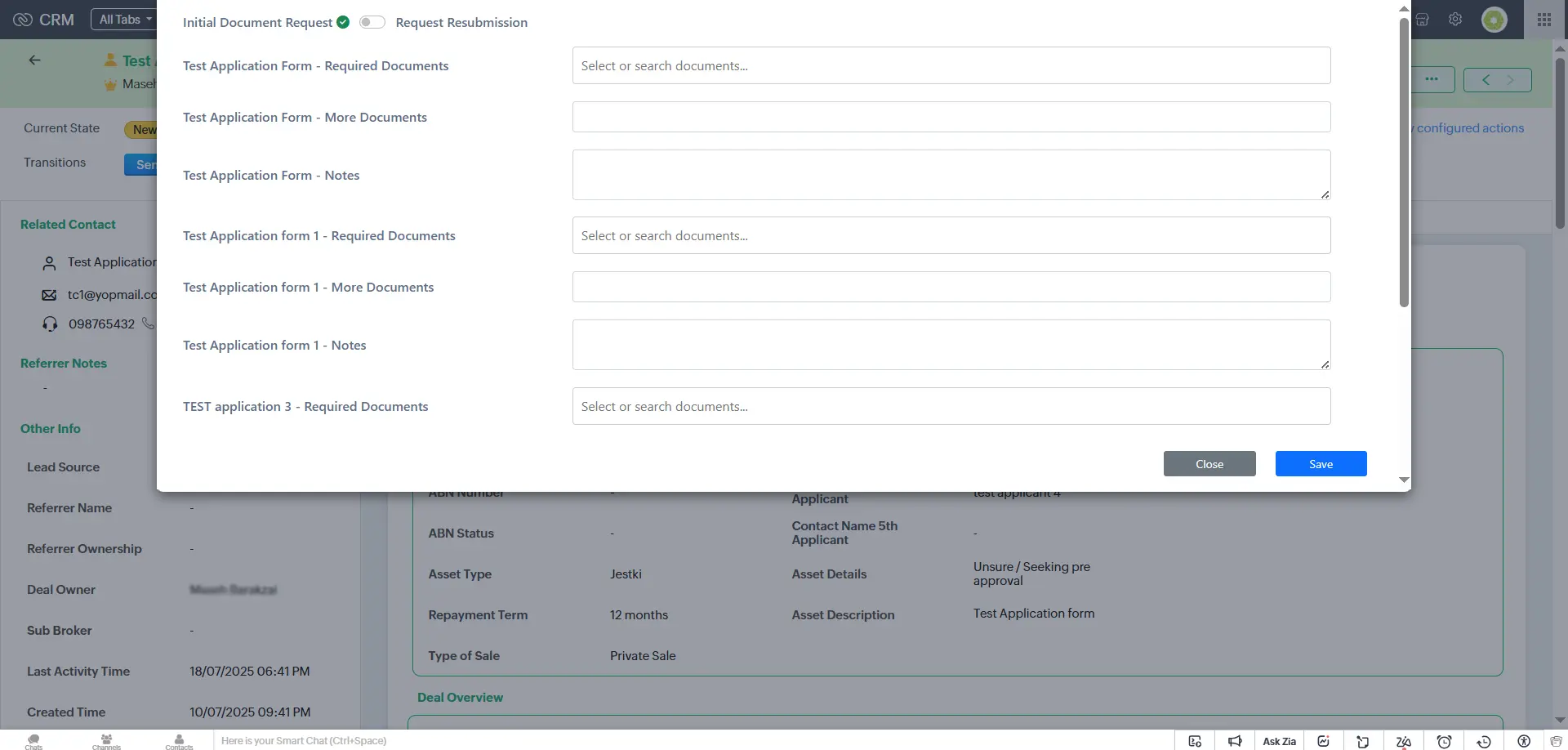

7. Build Custom widget for monitoring document submission to facilitate loan approval for applicants.

Our Zoho Experts developed custom widgets in Zoho CRM to streamline document management. These widgets allowed brokers to view and manage required documents for each applicant, ensuring nothing was overlooked.

In a nutshell, Our Solution not only addressed operational pain points but also positioned Pure Capital for long-term growth and customer satisfaction. YAALI proved to be more than a Zoho Implementation Partner - we became a strategic partner in Pure Capital’s growth.

YAALI's deep expertise in Zoho CRM Customization and its consultative approach allowed Pure Capital to evolve from a manually intensive process to a digitally enabled, customer-centric operation.

Results and Impact:

YAALI’s strategic implementation delivered measurable, impactful results:

-

-

Reduced Human Error: Automating privacy document dispatch and validation reduced manual mistakes significantly.

-

Accelerated Document Handling: Centralized upload and tracking avoided duplication and cut processing time.

-

Improved Customer Experience: Applicants received timely communication via their preferred channels (email and SMS), making the process more transparent and stress-free.

-

Increased Operational Efficiency: The team at Pure Capital could handle more applications with the same resources.

-

Boosted Business Profitability: With automation reducing admin work and improving turnaround times, the brokerage saw notable gains in productivity and revenue.

-

Looking ahead

YAALI continues to work with Pure Capital on additional enhancements:

-

-

Advanced analytics and reporting dashboards

-

Mobile application for field staff

-

Enhanced referrer portal features

-

Predictive analytics for application success

-

The Conclusion:

The success of this project highlights the importance of choosing a Zoho Partner who understands both the technical requirements and business nuances of financial services.

Through strategic implementation of Zoho CRM, Zoho Creator, Zoho Sign, and CellCast allowed Pure Capital to move from manual loan application processes to streamlined, and automated operation.

Most importantly, Pure Capital now operates with greater confidence, delivering faster, more reliable services to its clients and referrers.